(917) 275-7306

Fast, Affordable Business Funding Up to $5,000,000

Secure up to $5M in growth capital without drowning in paperwork or predatory rates.

Find the Right Funding Option and Get Approved—Fast

CLICK BELOW TO WATCH FIRST!

4.9/5 star reviews

Thousands of happy customers worldwide

See How We Put Capital In Your Hands—When Banks Won’t

Does this sound like you?

Wasting weeks filling out separate applications for every lender.

Getting denied for credit reasons you don’t understand.

Accepting sky-high interest offers because you think they’re the only option.

Not knowing which funding product best fits your cash-flow needs.

Missing growth opportunities because capital isn’t available when you need it.

Complete one simple application and let us shop the market for you.

See exactly how to boost approval odds—even with imperfect credit.

Compare transparent offers side by side and choose the lowest cost.

Access specialized programs that require little or no collateral.

Get funded again—faster and for more—as your business grows.

What You Receive With Currency Connector

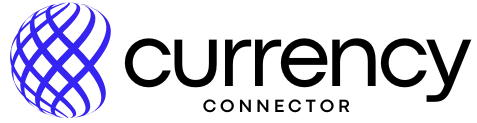

Funding Eligibility Audit

Assess your business profile, credit, and financials so you know exactly what you qualify for.

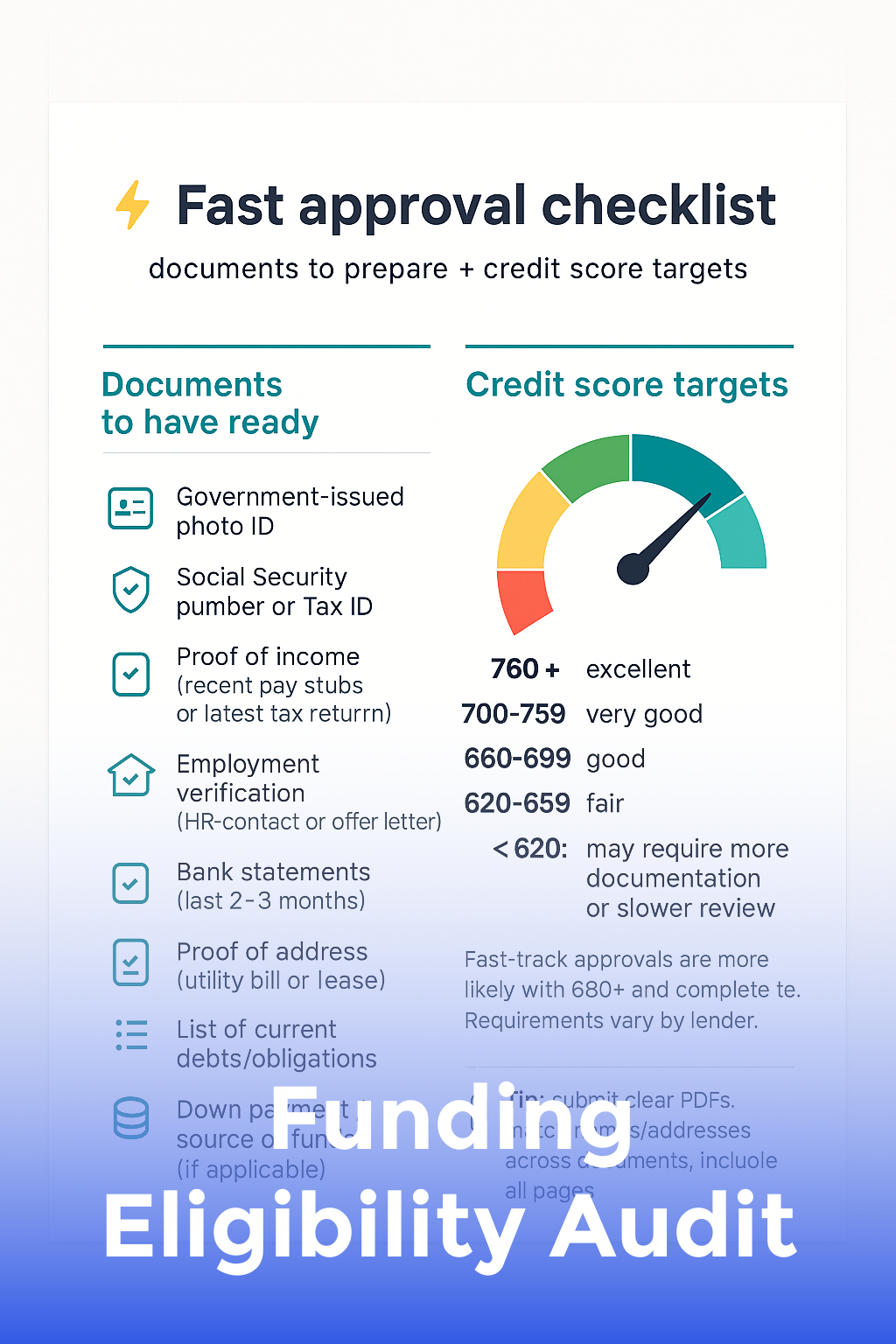

Smart Lender Matching

See how our proprietary system matches you to the ideal lender inside our 200+ partner network.

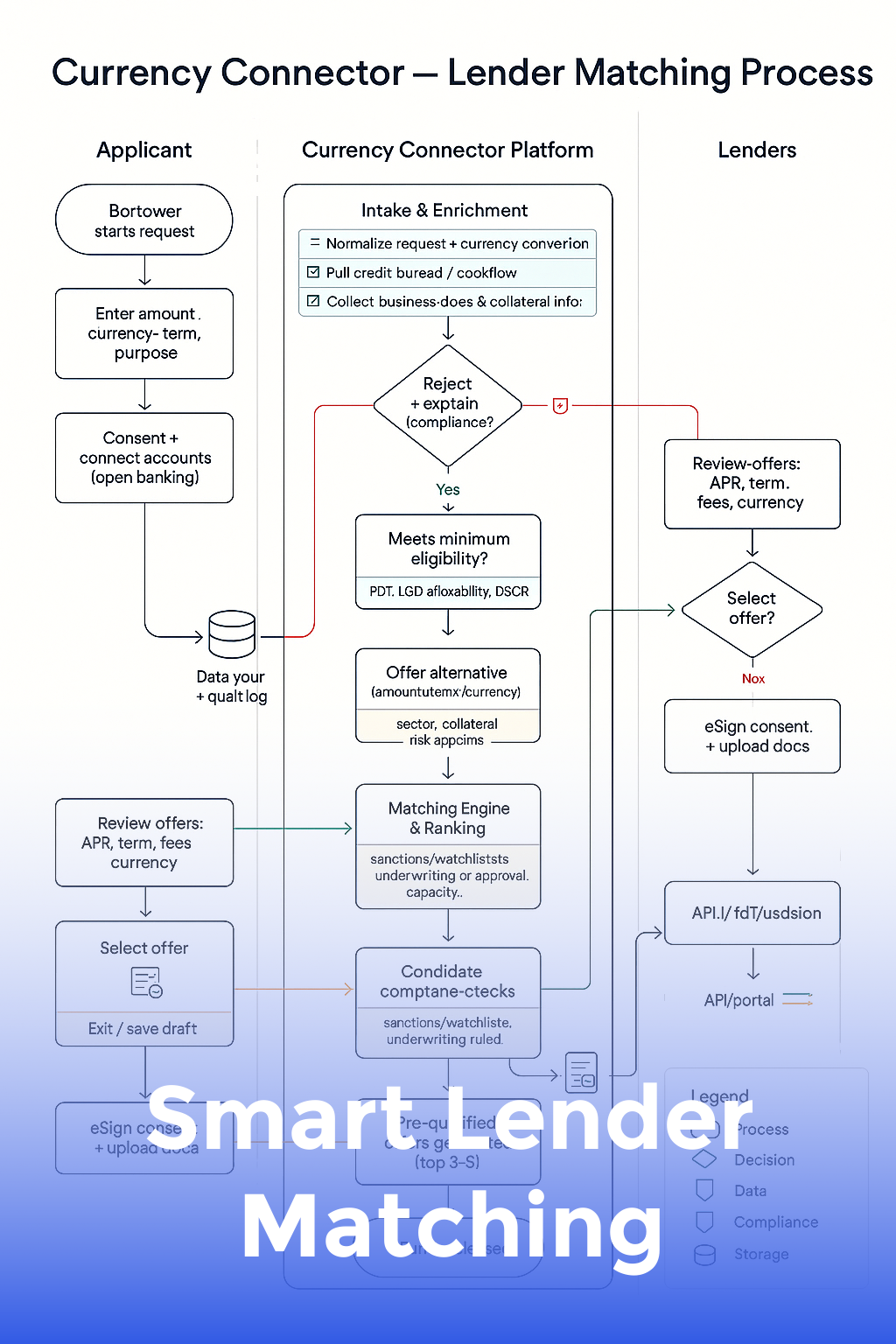

SBA Loan Blueprint

Step-by-step roadmap for securing low-rate SBA 7(a) and 504 loans.

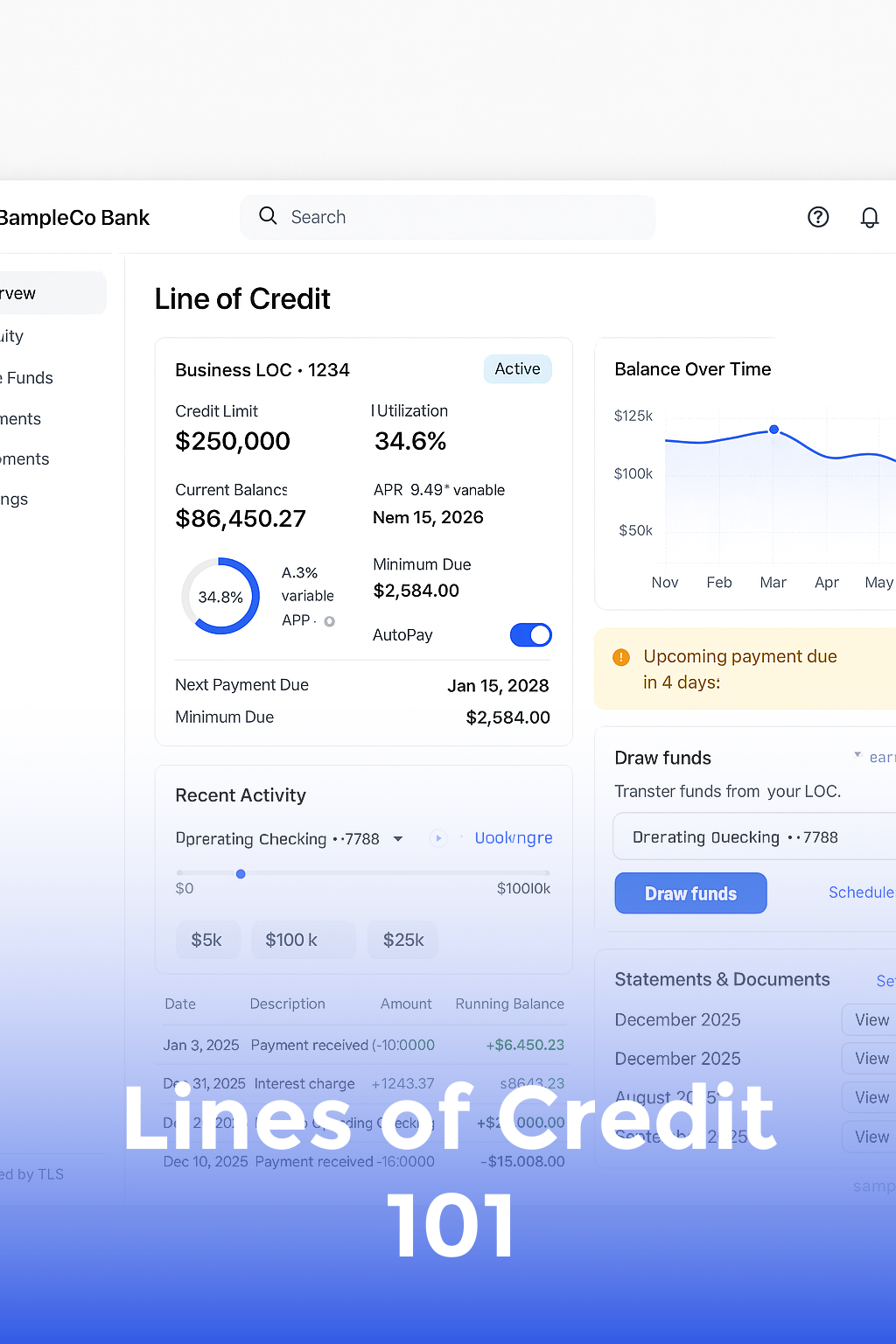

Lines of Credit 101

Learn how revolving lines of credit can solve cash-flow gaps and seasonal swings.

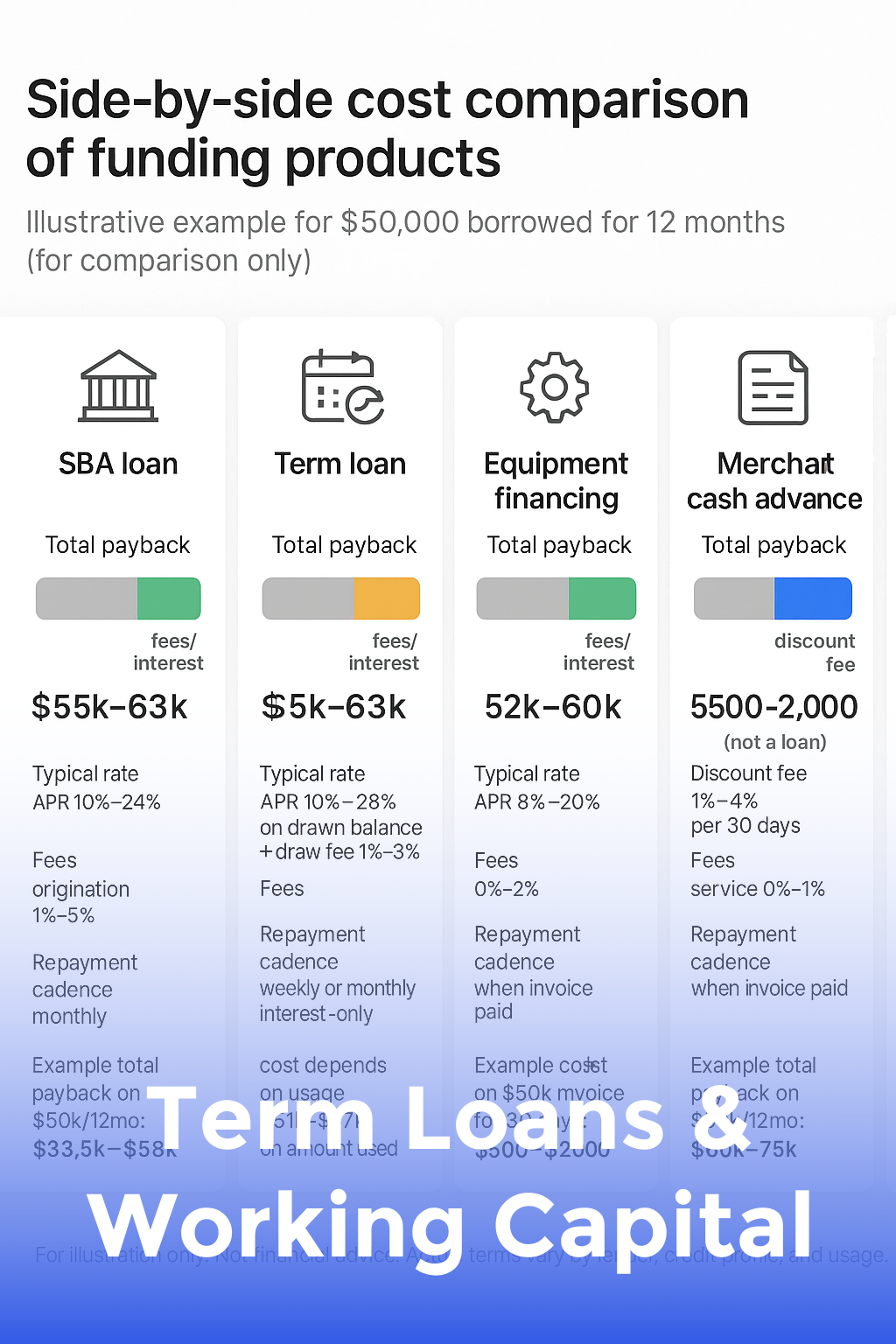

Term Loans & Working Capital

Compare term loans and merchant cash advances so you never overpay for working capital.

Equipment Financing Made Easy

Discover no-down-payment options for financing vehicles, machinery, and technology.

TESTIMONIALS

What our clients are saying...

" We secured $350K in working capital in just three days—at half the rate our bank quoted. Currency Connector is a lifesaver! "

- Amanda Brooks, E-commerce Founder

" Their team walked me through the SBA 7(a) process and got my restaurant a $1.2M loan for expansion. Couldn’t have done it without them. "

- Ronald

" I was rejected by two banks. Currency Connector matched me with a lender who approved a $500K line of credit within 48 hours. "

- Roberta Johnson

Funding Eligibility Audit

Assess your business profile, credit, and financials so you know exactly what you qualify for.

Smart Lender Matching

See how our proprietary system matches you to the ideal lender inside our 200+ partner network.

SBA Loan Blueprint

Step-by-step roadmap for securing low-rate SBA 7(a) and 504 loans.

Lines of Credit 101

Learn how revolving lines of credit can solve cash-flow gaps and seasonal swings.

Schedule a quick assessment

TO GET ACCESS TO CAPITAL

Term Loans & Working Capital

Compare term loans and merchant cash advances so you never overpay for working capital.

Equipment Financing Made Easy

Discover no-down-payment options for financing vehicles, machinery, and technology.

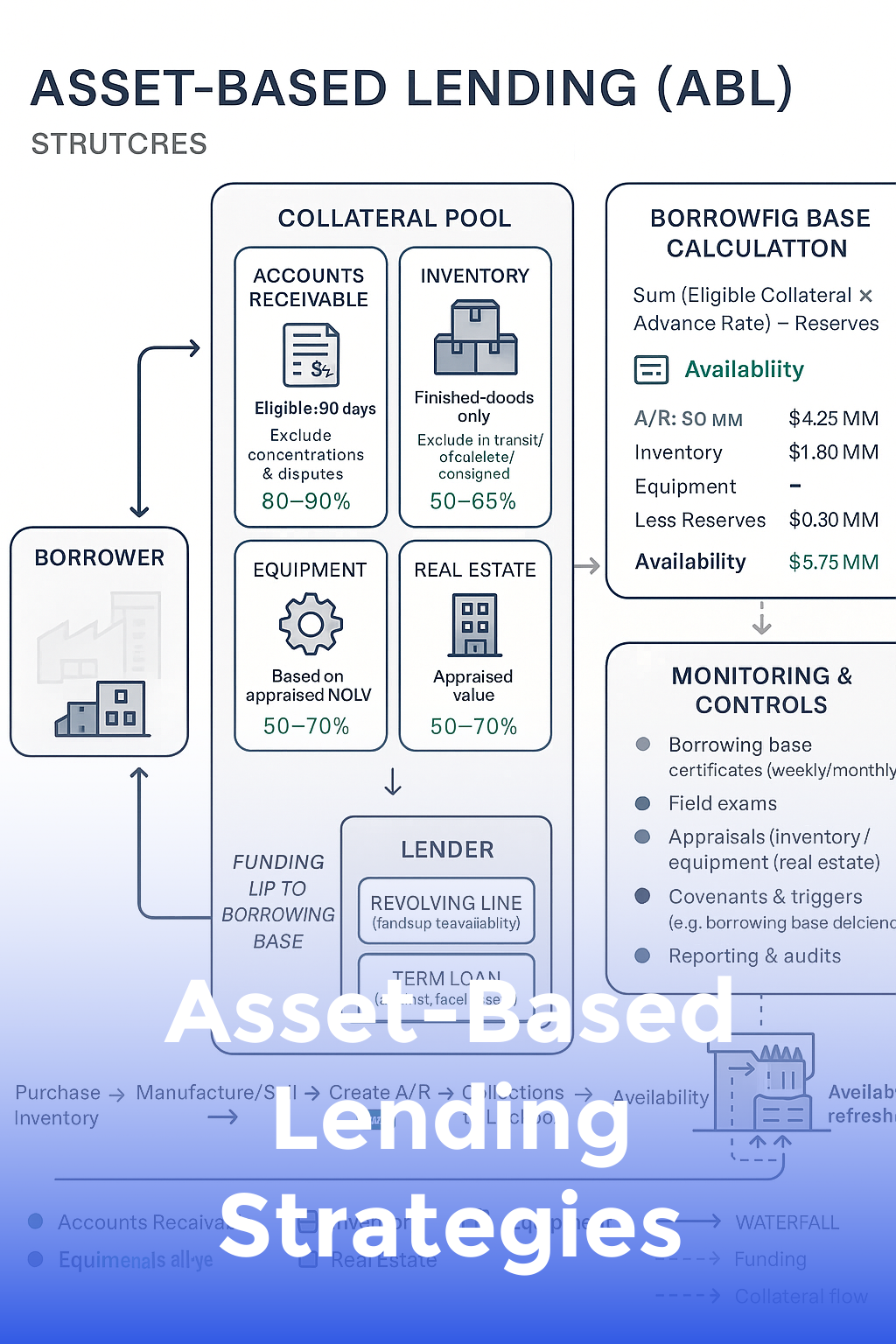

Asset-Based Lending Strategies

Leverage receivables, inventory, or real estate to qualify for larger credit lines.

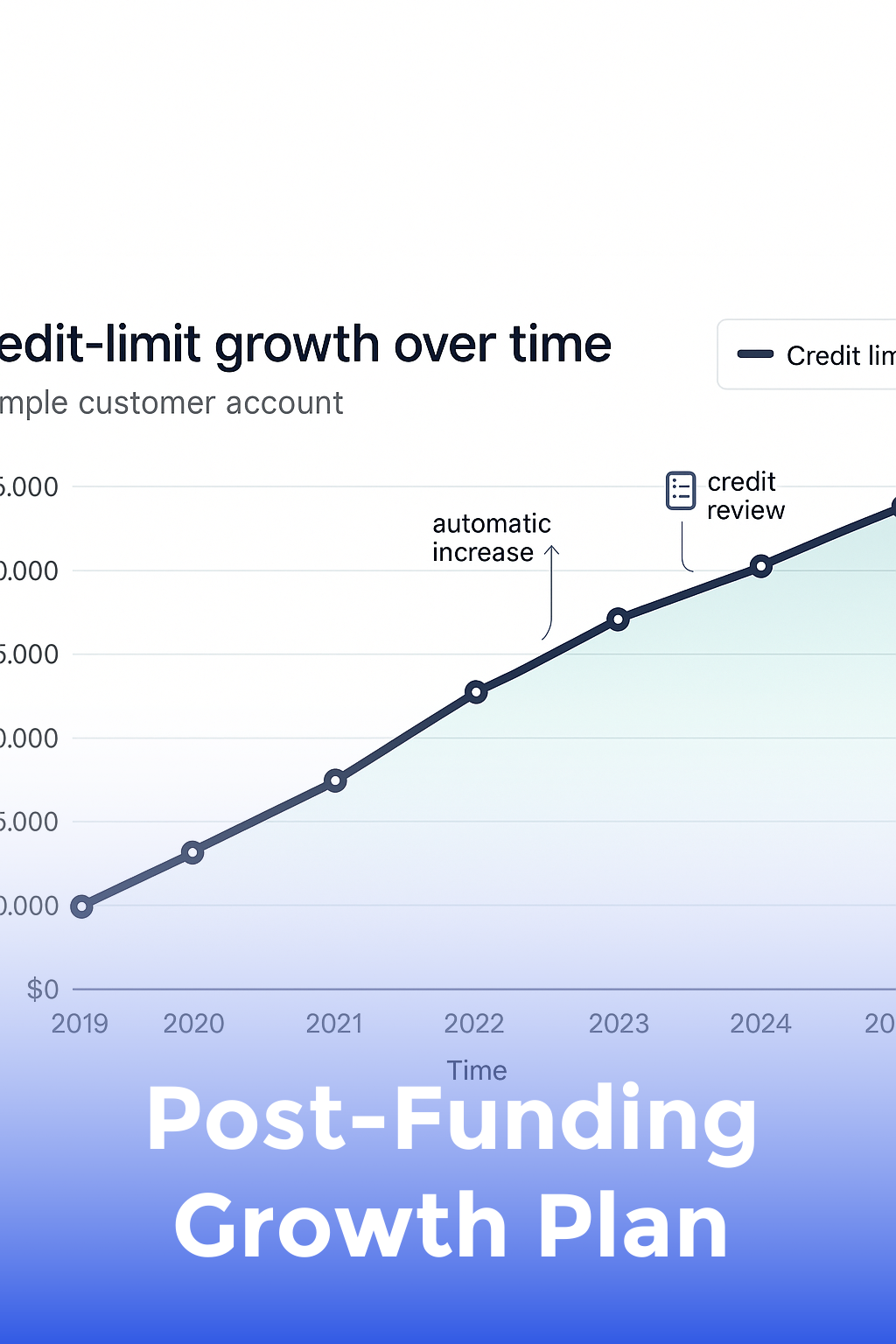

Post-Funding Growth Plan

Maintain stellar repayment history and unlock bigger limits with our post-funding support.

4.9/5 star reviews

Get Funded in as Little as 48 Hours

Our end-to-end funding service connects you directly with the best-fit lenders for SBA loans, lines of credit, term loans, and more—no endless paperwork or hidden fees.

Here's what you get:

Dedicated funding advisor from application through funding.

Access to our private marketplace of 200+ lenders with exclusive rates.

Personalized credit and financial analysis with a clear action plan.

Lifetime support and re-funding services at no extra cost.

Today Just

Reach out to us

"Got approved for $100K LOC!"

" Their team walked me through the SBA 7(a) process and got my restaurant a $1.2M loan for expansion. Couldn’t have done it without them. "

ABOUT THE FOUNDER

Meet Saavi

Currency Connector is led by Saavi Eto, a financial consultant to struggling business owners with 8 years of experience underwriting small-business loans for top national banks.

Saavi saw thousands of healthy businesses rejected or overcharged by traditional lenders, so she built Currency Connector to simplify and democratize access to capital.

Clients obtain anywhere from $25K to $5M in capital, cut interest costs by up to 30%, and gain the runway to hire, market, and expand.

Secured more than $500,000,000 in funding for clients.

Maintains a 95% approval success rate for qualified applicants.

Featured by Forbes, Inc., and Entrepreneur for innovative funding solutions.

Built a marketplace of 200+ SBA-preferred, bank, and fintech lenders.

Holds a 4.9/5 average client-satisfaction rating across 1,200+ reviews.

Regular speaker at SBA and SCORE events nationwide.

WHO IS THIS FOR...

For growth-focused business owners who need quick, affordable capital to start, scale, or stabilize their companies.

E-commerce Stores

Restaurants & Food Services

Manufacturing & Industrial Companies

Professional Services Firms

Logistics & Transportation

Health & Wellness Practices

Construction & Trades

Tech Startups

STILL NOT SURE?

Satisfaction guaranteed

We want you to find value in our service! We offer in-house funding and simplify how to qualify for capital if there is no offer, we are confident you WILL become lender-approved!

STILL GOT QUESTIONS?

Frequently Asked Questions

How fast can I receive funds?

Qualified businesses can receive capital in as little as 48 hours after submitting the required documentation.

What credit score do I need?

We offer programs that range from 720+ credit-score requirements to revenue-based products that don’t consider personal credit at all.

Will applying hurt my credit?

No. We start with a soft pull to pre-qualify you. A hard inquiry happens only when you accept a specific offer.

Get access to capital now!

Copyrights 2025 | Currency Connector™ | Terms & Conditions

Instagram

TikTok